jacksonville fl county sales tax

Capped at 10 increase annually. Exempt up to 25000.

Explainer Duval County Schools Half Cent Sales Tax Vs Millage Rate Increase

A county-wide sales tax rate of 15 is applicable to localities in Jackson County in addition to the 6 Florida sales tax.

. 1 Administer tax law for 36 taxes and fees processing nearly 375 billion and more than 10 million tax filings annually. For tax rates in other cities see Florida sales taxes by city and county. Lake County FL Sales Tax Rate.

734 rows Combined with the state sales tax the highest sales tax rate in Florida is 75 in the. The 75 sales and use tax must be remitted to the State of Florida Department of Revenue DOR. This is the total of state county and city sales tax rates.

This table shows the total sales tax rates for all cities and towns in Duval County. Jefferson County FL Sales Tax Rate. 15 capped at the first 5000 Estate Tax.

Lee County FL Sales Tax Rate. This document provides a history of the locally-imposed county tax rates. Depending on the zipcode the sales tax rate of Jacksonville may vary from 6 to 7.

Florida has a 6 sales tax and Duval County collects an additional 15 so the minimum sales tax rate in Duval County is 75 not including any city or special district taxes. 6 numerous exemptions available Local Sales and Use Tax. Every 2018 combined rates mentioned above are the results of Florida state rate 6 the county rate 05 to 1.

A transient rental carries a total tax rate of 135. State Sales and Use Tax. Florida Department of Revenue - The Florida Department of Revenue has three primary lines of business.

Tax Department 231 E Forsyth St Room 130 Jacksonville FL 32202. The County sales tax rate is. History of Florida Sales and Use Tax 3 - November 1 1949 to March 31 1968 4 - April 1 1968 to April 30 1982 5 - May 1 1982 to January 31 1988.

Sales tax is added to the price of taxable goods or services and collected from the purchaser at the time of sale. The total sales tax rate in any given location can be broken down into state county city and special district rates. The Jackson County Sales Tax is 15.

The TDT is in addition to the 75 taxes collected for sales and use which is remitted to the State of Florida Department of Revenue DOR. Explore how Jacksonville applies its real property taxes with our thorough outline. If you are already a resident thinking about it or perhaps planning to invest in Jacksonville read on to acquire.

Many answers regarding property taxes can be found in the FAQ section of this website. You can print a 75 sales tax table here. 55 of federal adjustments.

Inquire about your property on the link below or contact the Tax Collector by phone or email. Jacksonville Beach collects the maximum legal local sales tax. The Florida sales tax rate is currently.

Liberty County FL Sales Tax Rate. 3 Oversee property tax administration. The Jacksonville sales tax rate is.

Ed Ball Permitting Branch 700 am. Tangible Personal Property Tax. You may renew Local Business Tax Receipts by mail or at our any one of our branch locations.

Forsyth Street Jacksonville FL 32202 904 255-5700 Email. Local Business Tax 231 E. The minimum combined 2022 sales tax rate for Jacksonville Florida is.

There is no applicable city tax or special tax. Forsyth St Suite 130 Jacksonville FL 32202. Madison County FL Sales.

Florida has 993 cities counties and special districts that collect a local sales tax in addition to the Florida state sales taxClick any locality for a full breakdown of local property taxes or visit our Florida sales tax calculator to lookup local rates by zip code. Duval County Tax Collector 231 E. None on stock or other equity Corporate Income Tax Type C.

2 Enforce child support law on behalf of about 1025000 children with 126 billion collected in FY 0607. Leon County FL Sales Tax Rate. 4 on amusement machine receipts 55 on the lease or license of commercial real property and 695 on electricity.

Jackson County FL Sales Tax Rate. There is no applicable city tax or special tax. None of the cities or local governments within Jackson County collect additional local sales taxes.

The Jacksonville Florida general sales tax rate is 6. The 75 sales tax rate in Jacksonville Beach consists of 6 Florida state sales tax and 15 Duval County sales tax. Lafayette County FL Sales Tax Rate.

You can print a 75 sales tax table here. Voters in Duval County said yes to a half-cent sales tax increase to raise nearly 2 billion to fund improving the citys schools over the next 15. Jacksonville collects the maximum legal local sales tax.

The 75 sales tax rate in Jacksonville consists of 6 Florida state sales tax and 15 Duval County sales tax. If you have any changes to the information on the Local Business Tax renewal you should visit our downtown office 231 E Forsyth St Suite 130 Jacksonville FL. If you need access to a database of all Florida local sales tax rates visit the sales tax data page.

For more information regarding the tax sale process tax certificates or tax deeds please contact the Tax Department at 904 255-5700 option 4 or correspondence may be mailed to. Duval County Tax Collector Attn. For more information call the Departments Taxpayer Assistance at 850-488-6800 Monday through Friday excluding holidays.

Floridas general state sales tax rate is 6 with the following exceptions. Only the TDT is remitted to Duval County. To pay in person.

Levy County FL Sales Tax Rate.

Explainer Duval County Schools Half Cent Sales Tax Vs Millage Rate Increase

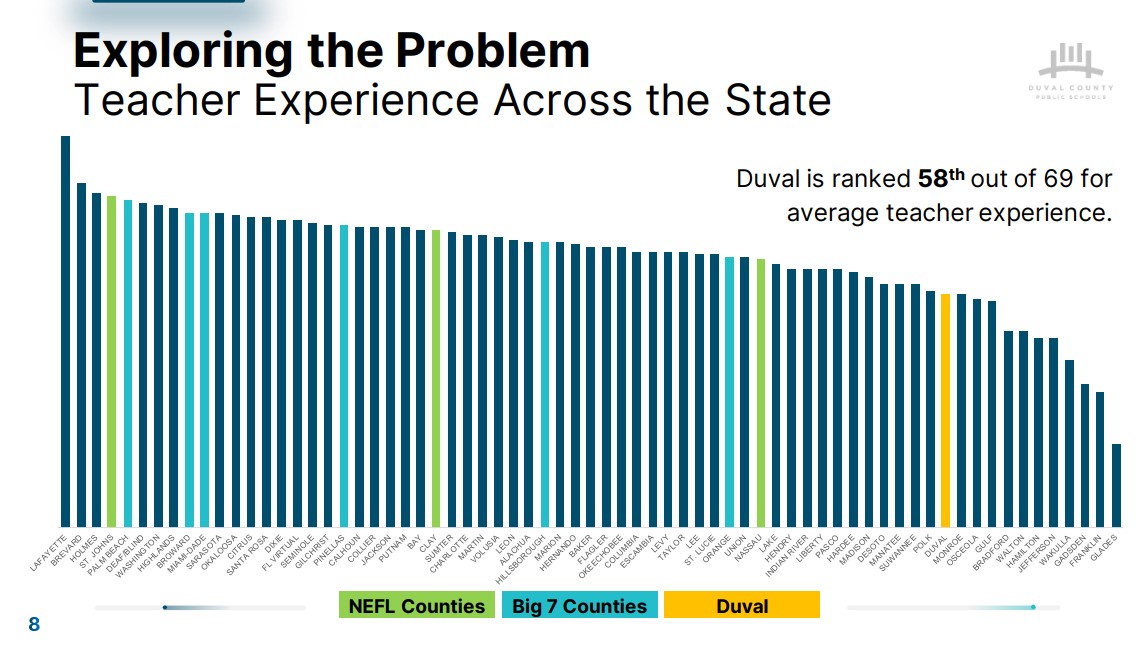

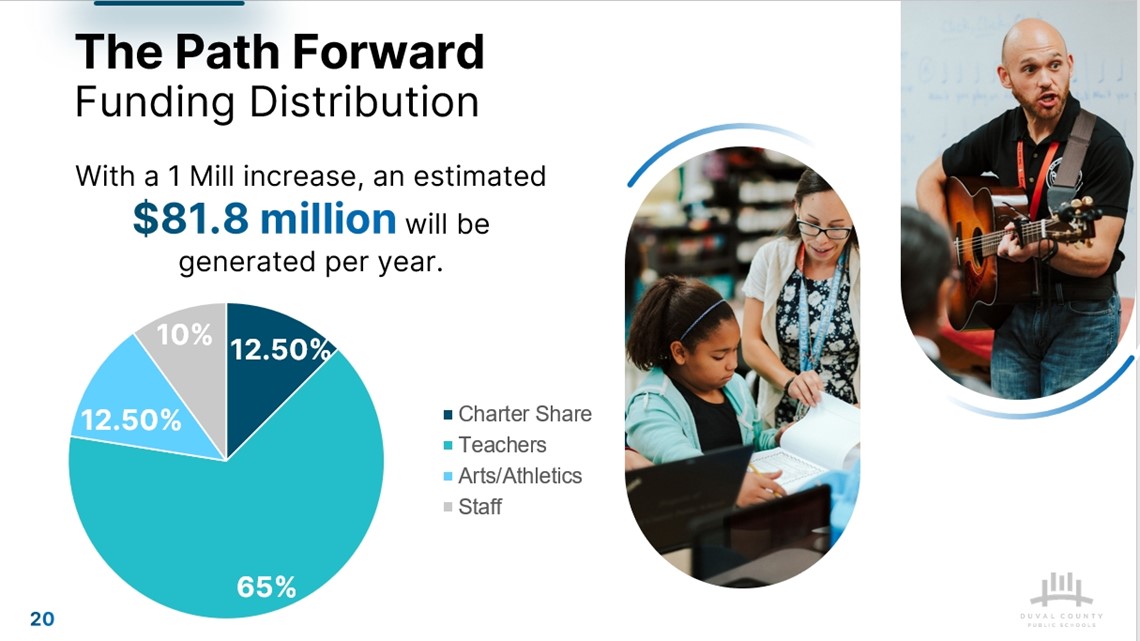

Breakdown Of The Proposed Property Tax Hike For Duval County Schools

Map Of Health Zones In Duval County Florida Showing Distribution Of Download Scientific Diagram

Breakdown Of Proposed Property Tax Hike For North Florida Schools Firstcoastnews Com

Duval County Courthouse Closed To The General Public Jax Daily Record Jacksonville Daily Record Jacksonville Florida Duval County Courthouse Florida

Jacksonville Mayor On Billboards Around The Country Firstcoastnews Com

Florida Sales Tax Guide For Businesses

Duval County Tax Collector Downtown Jacksonville

Florida Sales Tax Small Business Guide Truic

Duval Sales Tax Referendum Our Duval Schools Jacksonville Duval County Duval Public School

Map Of Health Zones In Duval County Florida Showing Distribution Of Download Scientific Diagram

County Property Tax Payment Deadline Jennifer Sego Llc

Property Tax Search Taxsys Duval County Tax Collector

Duval County Tax Collector S Office Home Facebook

Florida Property Tax H R Block

Jacksonville City Council Doubles Tax Break For Low Income Seniors

Duval County Property Appraiser Tax Estimator

Florida Sales Tax Rates By City County 2022

Report Duval S Half Cent Sales Tax Garners 110m In 1st Year But Public Awareness Needs Improvement